US markets began the week on a subdued note, with investors awaiting corporate earnings reports and inflation data to weigh against the potentially damaging economic effects of the Delta coronavirus variant.

Wall Street’s blue-chip S&P 500 closed 0.4 per cent higher, building on the high hit on Friday. The tech-focused Nasdaq Composite moved up 0.2 per cent.

Earnings season on Wall Street begins in earnest on Tuesday with

JPMorgan Chase and Goldman Sachs reporting results. Analysts have forecast earnings for companies on the S&P 500 index to surge more than 60 per cent in the second quarter from the same time last year. It would mark the second-straight quarter of sharp profit increases, a sign big US groups are recovering swiftly from the pandemic.

“By and large, the results should be very good,” said Salman Baig, a portfolio manager at Unigestion. However, he added that if companies that fall short of earnings expectations are punished more than those who beat them are rewarded, then this would signal a warning that investors are “overly optimistic”.

Investors are also expected to pay close attention to a report on US consumer prices, due on Tuesday, which is expected to show that inflation has remained hot in America because of supply chain issues, elevated commodities prices and a bounce back in the broader economy from the depths of the pandemic a year ago.

Baig said the spectre of a sustained period of high inflation was “something we’ve been concerned about for many months”. Still, many economists expect the recent surge in US price growth will eventually fade, relieving pressure on the Federal Reserve to tighten monetary policy sooner than expected.

Patrick Spencer, vice-chair of equities at Robert W Baird, said issues such as supply chain problems had already been priced in, with attention instead turning to the second-quarter earnings season and companies’ outlooks for next year.

“Even though you might have peak earnings [in the second quarter], you’re still going to see reasonable earnings next year,” Spencer said.

The rapid spread of the Delta variant has also caught investors’ attention. The strain already accounts for the majority of new cases in many European countries and is driving infection rates up to their highest level for months.

While vaccination programmes have helped to break the link between infections and serious illness and deaths, any renewed social curbs would place further pressure on economies recovering from the Covid-19 crisis, said analysts.

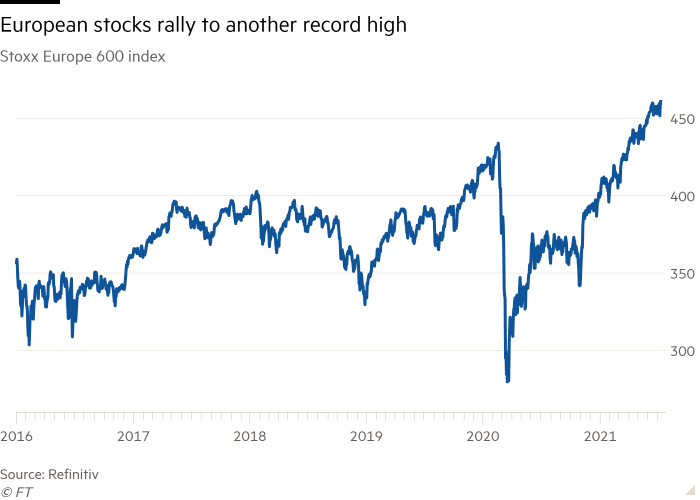

Across the Atlantic, the equity moves were firmer. The continent-wide Stoxx Europe 600 closed up 0.7 per cent at a high, while Frankfurt’s Xetra Dax index climbed by the same margin and the CAC 40 in Paris rose 0.5 per cent.

Jay Powell, Federal Reserve chair, will also deliver semi-annual testimony to Congress on Wednesday and Thursday, offering a further opportunity for investors watching for any change on the US central bank’s direction.

Other central bankers have also drawn attention in recent days. European Central Bank president Christine Lagarde said over the weekend that its governing council session on July 22 would have “some interesting variations and changes”.

Brent crude, which hit a multiyear high last week of $77.84 a barrel following the failure of Opec+ members to decide on the level of output, fell 0.5 per cent to just above $75 a barrel.

Unhedged — Markets, finance and strong opinion

Robert Armstrong dissects the most important market trends and discusses how Wall Street’s best minds respond to them. Sign up here to get the newsletter sent straight to your inbox every weekday