The EU’s proposal for a carbon border levy to combat climate change has triggered a sharp response from trading partners led by Russia, while others are considering adapting their climate policies in response.

The plan for the introduction of the first major climate import tariff in the world by 2026 would see a cost placed on carbon emissions through a so-called carbon border adjustment mechanism (CBAM).

It would impose a levy linked to carbon prices on an array of products such as imported steel, aluminium, fertiliser and cement.

Economists regard the EU measure, unveiled on Wednesday, as a critical test case and are closely watching to see whether it succeeds in incentivising the lowering of emissions and prompts other countries to follow Brussels’ lead.

Among major EU trading partners, Russia hit out at the proposal and calculated that it stood to lose $7.6bn from it, making Moscow potentially one of the biggest losers from the measures.

It is Europe’s biggest supplier of carbon-intensive products, such as oil, coal, rolled steel and aluminium, worth an estimated €10bn in 2019. Total EU imports from Russia amounted to €145bn in 2019, making the bloc Moscow’s largest trading partner, while Russia is the EU’s fifth-largest trading partner.

“The prospect of an additional financial burden for our economy and our companies is extremely unpleasant,” Dmitry Peskov, president Vladimir Putin’s spokesman, told the FT.

EU leaders say the policy is aimed at companies not countries, and emphasise they want to co-operate as widely as possible with other governments on carbon pricing.

“This is an environmental policy tool, not a tax, not a tariff. It is in line with and compliant with international trading rules,” said Paolo Gentiloni, the EU’s economy commissioner.

Trade Secrets

The FT has revamped Trade Secrets, its must-read daily briefing on the changing face of international trade and globalisation.

Sign up here to understand which countries, companies and technologies are shaping the new global economy.

Gentiloni said finance ministers in the G20, who met in Venice earlier this month, had received the carbon border proposal “positively”. However he acknowledged that “there is a lot of attention, curiosity and concern about this decision at the global level”.

As the EU prepares to become the first bloc in the world to impose a levy on carbon-intensive goods at its border, some allies appear to be observing its example.

Democrats in the US this week advocated a carbon border tax, even though the country lacks a national carbon pricing mechanism. Canada is also debating such a move.

Russia was keen to discuss the issue directly with the EU, Peskov said, but there was little hope of doing so after some member states rejected France and Germany’s proposal for a summit with Putin, he added.

“Dialogue has essentially collapsed [ . . .] but issues like decarbonisation make restoring that dialogue essential, because we need to discuss it,” Peskov said.

Sir Dieter Helm, an energy economist and prominent advocate of carbon pricing, said lobbying from exporters such as China and Russia was inevitable, and a sign of how powerful the CBAM could be as a tool to induce other countries to adopt carbon pricing.

“Anyone can get an exemption to the CBAM if they have an equivalent [carbon price] at home,” he said. “So anyone who wants to extend carbon pricing, gets to be within the coalition of the willing.”

The carbon border proposals are “by far the most important part of all the bits of the [green recovery] package”, Helm added, referring to the 13 proposals that the European Commission unveiled this week.

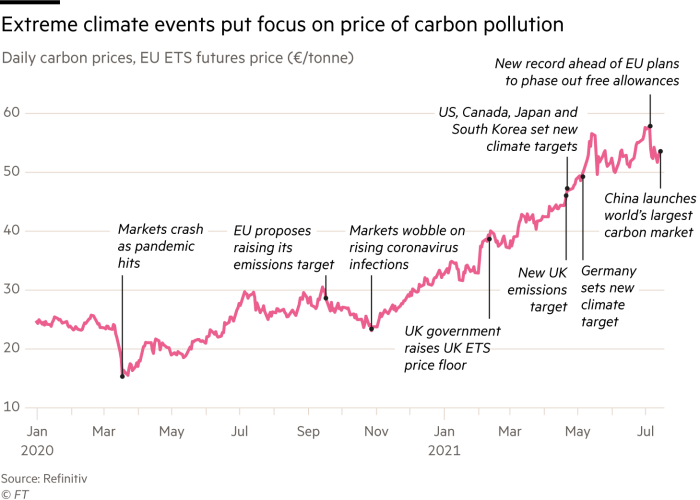

China has also been vocal in its opposition to the EU’s carbon border tax, but at the same time has been taking steps to introduce carbon pricing and this week launched a national emissions trading scheme for the energy sector.

The EU proposals still face years of negotiations in Brussels before they become law, although, unlike other some parts of the green legislative agenda, they have broad backing from European industry leaders who see the levy as a means to fend off foreign competitors.

In addition to Russia, the countries most affected by a carbon tariff would include Turkey, which accounts for a third of Europe’s cement imports and 12 per cent of steel, and China, which furnishes 14 per cent of steel imports.

Additional reporting by Ayla Jean Yackley

Follow @ftclimate on Instagram

Climate Capital

Where climate change meets business, markets and politics. Explore the FT’s coverage here.

Are you curious about the FT’s environmental sustainability commitments? Find out more about our science-based targets here