This article is an on-site version of our Unhedged newsletter. Sign up here to get the newsletter sent straight to your inbox every weekday

Welcome to a new week. We get the June jobs numbers on Friday, which could add to the Fed/inflation/markets drama. But if the US markets are a drama, emerging markets are a full-on opera production. My attempt to summarise the libretto follows.

Emerging markets, part 2

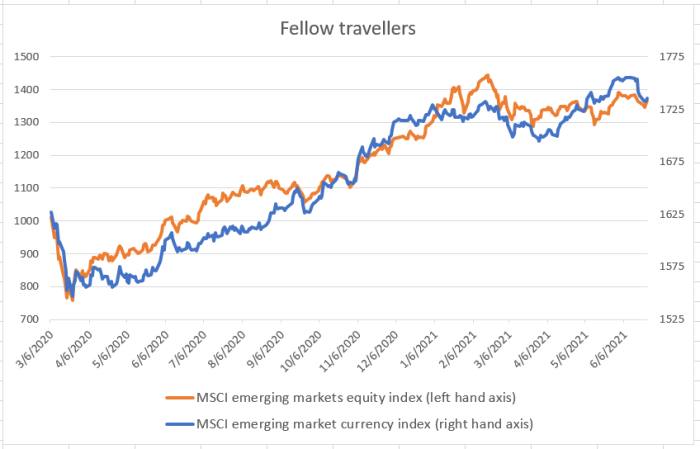

Emerging markets stocks, as I wrote last week, have had a strong run since they hit bottom in March of last year. A lot of that has to do with the strong performance of EM currencies. Here is the MSCI EM currencies index, which is weighted to match the equity index of the same name, also shown (via Bloomberg):

In the past decade or so, currencies have given EM investors a rough ride. But recently a soft dollar, negative US real rates and a recovery in commodities prices (among other factors) have broken that pattern. As ever, the index conceals a lot of complexity. Here is how some of the key individual currencies did:

What that rather confusing collection of lines tells you is how much the MSCI index is weighted towards China, and to South Korea and Taiwan, two countries that play an important role in Chinese supply chains. Part of what we see in the EM index strength, then, is China’s success in containing the coronavirus quickly. Other than that, Turkey’s misery is clear, India has hung in there, and two great commodities’ currencies, the real and the rouble, have done OK, considering the pandemic.

There is at least one reason to think that some of the EM currencies might continue to be strong. Several emerging market central banks are raising rates, even as the US dithers. Russia, Brazil, Mexico, Hungary, and the Czech Republic all tightened policy in June. The spectre of inflation is more vivid in these markets, and their central bankers cannot afford to wait for the US to go first.

This has made these countries’ longer-term, local-currency bonds attractive, Ed Al-Hussainy of Columbia Threadneedle pointed out to me. Their yield curves remain relatively steep, and so there is significant carry and rolldown returns to be harvested, but inflation is now less of a risk.

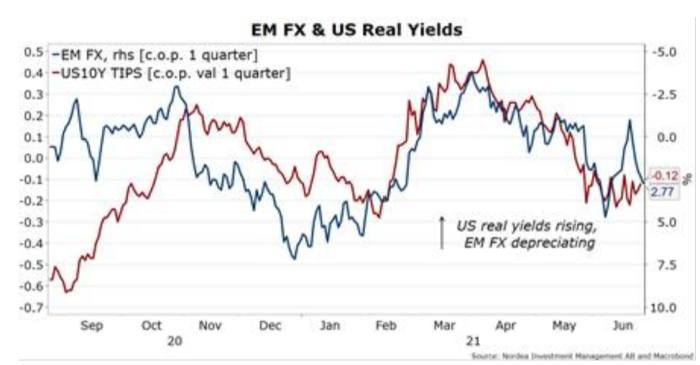

That said, there is a clear cautious consensus on EM assets. It is driven by the view that as the US prepares to taper asset purchases and contemplates higher interest rates, the dollar and US real rates will rise — leading to a replay of the beating EM assets took in the 2013 taper tantrum. Witold Bahrke of Nordea Asset Management sent this chart of US real rates against an EM currency index:

If the dollar and US real rates are rising as commodity prices are falling, commodity-driven markets like Brazil and Russia will be hit particularly hard. And tightening of credit conditions in China is making markets nervous that exactly that may happen (chart from Bloomberg):

Luis Costa, EM strategist at Citigroup, sums it up: “Investors are happy to stay cautious” ahead of the Fed’s conference in Jackson Hole in August, where the central bank may give more hints about its plan.

So much for the gloomy view. There is a more bullish case to be made, built on two pillars.

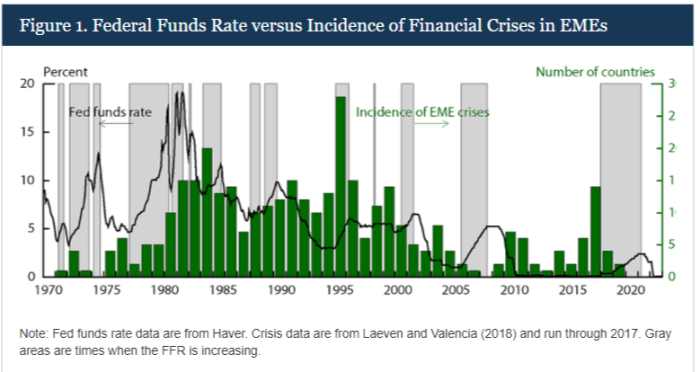

The first pillar is the fact that not all Fed tightening cycles are bad news for EMs. The Fed itself just published a research note on this topic. Below is the note’s crucial conclusion and the accompanying chart. So long as US tightening cycles are driven by strong growth prospects, rather than inflation concerns, EM’s can muddle though OK:

A rise in interest rates driven by favourable growth prospects is likely to have relatively benign effects on emerging financial markets, since the benefits of higher US GDP through increased import demand from its trading partners and increased investor confidence should mute the costs of higher rates. Conversely, if higher rates are driven mainly by worries about inflation or a hawkish turn in Fed policy . . . this will probably be more disruptive for emerging markets.

The chart shows the federal funds rate against the number of countries experiencing financial crises, defined in terms of bank failures, runs, government interventions in the financial system and so on (and yes, the right hand scale is missing a decimal place. That is how it appears on the Fed’s website; it should range from 0 to 30, not 0 to 3).

The key period in that chart is the mid-2000s, when “EMEs weathered rising US rates with few difficulties”. The argument is that this was a rate-rising cycle driven by growth, rather than inflation, and so was benign.

I must confess, however, that I’m not at all sure which kind of tightening cycle we are heading into. In the paper, the Fed distinguishes the two by looking at how bond yields and stocks move immediately after Fed policy announcements. If the two move up together, that’s a growthy policy change; if yields rise and stocks fall, that inflationy. But what happened this month? Initially stocks and yields diverged. But then stocks bounced back and yields fell again. So which is it?

And there is a third possibility, too: that growth disappoints, and we don’t have a tightening cycle at all.

But let’s assume for the moment that we will have a growthy tightening cycle. We must then consider the most important variable of all: the virus. Levels and rates of vaccination in emerging markets are all over the place. A sample, from Our World in Data:

There are two ways to look at this. One is that over the months to come many countries will be widely vaccinated, experience the economic renaissance that the US has already experienced, and therefore “the underlying trend is the upside”, as Simon Quijano-Evans of Gemcorp put it to me. The other is that we are going to see cases and shutdowns rise again before long, accompanied by more economic shutdowns. “Come the fall we will have another spike in Covid rates and deaths. Vaccination rates in lots of EMs are trivial,” Al-Hussainy worries, “and God forbid commodities roll over at the same time.”

One good read

Matt Klein, a brilliant former FT colleague of mine, has written his final column for Barron’s. It is a sharp take on the debate among Fed governors; he sees more divisions in the open market committee than I do. Matt is now starting his own publication. You would do well to sign up for it, by emailing mattkleinpostbarrons@gmail.com.

Recommended newsletters for you

#fintechFT — The biggest themes in the digital disruption of financial services. Sign up here

Martin Sandbu’s Free Lunch — Your guide to the global economic policy debate. Sign up here