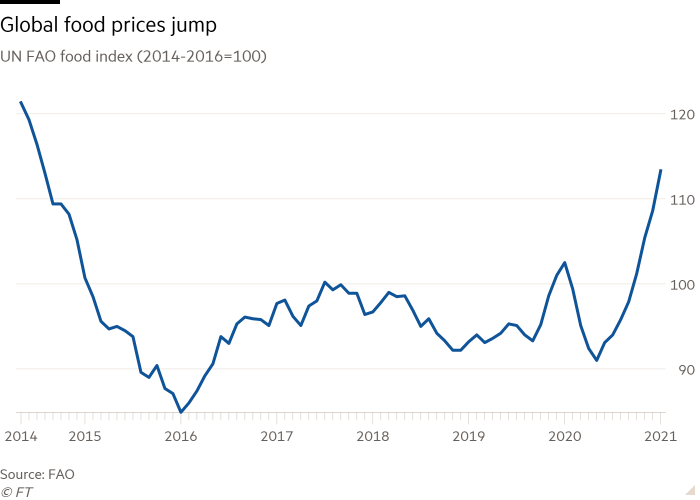

Global food prices have reached their highest in almost seven years, further raising the spectre of food inflation and hunger at a time when the Covid-19 pandemic continues to hit economies around the world.

The UN Food and Agriculture Organization’s food price index for January rose by a tenth from a year ago to its highest level since July 2014, led by a sharp increase in grain prices. Substantial buying of corn by China and lower-than-expected production in the US helped send the gauge — which tracks a basket of food commodities against their 2014-16 prices — to its eighth consecutive monthly increase, the longest rising streak in a decade.

Prices are not yet at levels seen during the food crisis of the late 2000s, but the trajectory was a concern, said analysts. “It could become a big issue for less prosperous countries which depend on imports for food,” said Abdolreza Abbassian, senior economist at the FAO.

China is seeking to restore its grain reserves, as well as keeping a lid on domestic prices while it rebuilds a hog herd that was decimated by African swine fever. The pandemic has also prompted countries reliant on imports for staples to boost government-held inventories in grains and oilseeds such as soyabeans, as well as sugar.

Food prices have also been affected by dry weather in South America, a leading supplier of corn and soyabeans to international markets, while expectations of a rise in export tariffs in leading wheat exporters such as Russia have also pushed prices higher.

The continued disruption in the shipping industry is another factor: freight prices for grains and oilseeds are at their highest levels since October 2019 according to the International Grains Council, a global body.

The rally in grains and soyabeans follows several years of low prices after favourable weather led to bumper crops. Corn prices are up 45 per cent from a year ago to $5.55 a bushel and soyabeans have jumped 56 per cent to $13.71. Wheat is up 16 per cent while rice is 27 per cent higher.

Analysts at Commerzbank said agricultural commodity markets were also supported by the broader, positive sentiment in equity markets, economic stimulus packages and rising oil-price forecasts. By mid-January, speculators’ net long positions in corn — overall bets that prices would rise — had reached their highest level since spring 2011, said Michaela Helbing-Kuhl. Then corn cost $7 a bushel.

The FAO also warned that the larger volumes of world trade and a sharp decline in global grain inventories, to the lowest level in five years, had made markets more vulnerable to production shortfalls.

The big question is whether Chinese demand will keep up its swift pace. China, which has historically bought about 3m to 5m tonnes of corn a year, imported a record 11m tonnes of the yellow grain in 2020, prompting analysts to raise their forecasts.

While China has continued its large purchases from the US this year, there is uncertainty about the longevity of the country’s overseas purchases, said Mr Abbassian. “The market is fuelled by expectations that China will continue buying. All of a sudden it could stop and then prices will drop sharply,” he said.

- Advertisement -